Title:

Introduction:

The world of surrogacy is a beautiful yet complex journey, woven with hopes, dreams, and the undeniable need for thorough planning. As intended parents and surrogates embark on this life-changing path, one fundamental aspect often takes center stage: surrogate health insurance. Navigating the intricate landscape of surrogate health insurance can be daunting, but understanding its nuances is essential for both parties involved.

In this listicle, we delve into 10 key factors to consider when it comes to surrogate health insurance. From understanding coverage specifics to evaluating potential out-of-pocket costs, this guide aims to equip you with the knowledge needed to make informed decisions. You can expect to gain insights into the types of policies available, the importance of comprehensive coverage, and critical questions to ask insurance providers. Whether you are an intended parent seeking to protect your surrogate or a surrogate herself wanting to ensure your health and wellbeing, this article will provide invaluable information to support your decision-making process. Let’s embark on this insightful journey together and help pave the way for a smoother surrogacy experience.

1) Understanding Coverage Options

Types of Coverage Available

When exploring surrogate health insurance, it’s essential to grasp the various types of coverage available that cater specifically to surrogates. Some options to consider include:

- Comprehensive Health Insurance: This type typically covers a multitude of healthcare needs, including prenatal care, hospitalization, and postnatal care for both the surrogate and the baby.

- Disability Insurance: Some policies provide financial support in case the surrogate is unable to work due to medical complications during the pregnancy.

- Life Insurance: In the unfortunate event of a surrogate’s death during pregnancy or childbirth, life insurance ensures that her dependents are financially protected.

Mandatory vs. Optional Coverage

Understanding the difference between mandatory and optional coverages is crucial when navigating surrogate health insurance. Mandatory coverages, often required by state laws, might include:

- Basic Medical Coverage: This ensures that essential medical expenses related to the pregnancy are covered.

- Emergency Care: Policies typically require provision for emergency medical situations that may arise.

On the other hand, optional coverages could encompass a range of benefits that surrogates may elect based on personal needs and circumstances, such as:

- Psychological Support: Therapy or counseling sessions that address emotional well-being during pregnancy.

- Additional Maternity Benefits: Such as access to specialized prenatal classes or lactation consultations.

Choosing the Right Plan

Selecting the ideal surrogate health insurance plan isn’t just about comparing prices. Attention must also be paid to network providers, coverage limits, and deductibles. A thorough understanding of these aspects can greatly affect the outcomes of the surrogate’s healthcare experience.

Consider creating a comparison table to streamline your decision-making process:

| Insurance Type | Pros | Cons |

|---|---|---|

| Comprehensive Health Insurance | Broad coverage, peace of mind | Higher premiums |

| Disability Insurance | Financial support when needed | May not cover all scenarios |

| Life Insurance | Security for dependents | Additional cost to consider |

As you navigate your options, it’s critical to dive deeper into how each coverage type aligns with not only the surrogate’s health needs but also her financial expectations. This comprehensive understanding will help ensure a smoother experience throughout the surrogacy journey, making the right insurance choice paramount to the success of the process.

2) Evaluating Waiting Periods

Understanding Different Types of Waiting Periods

When exploring surrogate health insurance, it’s crucial to dissect the various waiting periods that could affect your coverage. These can vary significantly by insurer and policy. Typically, waiting periods are the time frames during which policyholders must wait before certain benefits become accessible. Understanding these nuances can help you choose a plan that aligns with your specific needs.

- Initial Waiting Periods: Most health insurance policies impose an initial waiting period right after enrollment. This duration can range from a few days to several months, depending on the insurer.

- Benefit-Specific Waiting Periods: Some plans may have distinct waiting periods for certain types of coverage, such as maternity care or surrogacy-related medical expenses. These periods can affect when you can access critical services during the surrogate process.

Factors Influencing Waiting Period Length

The duration of waiting periods can be influenced by various factors, including the following:

- Insurance Provider: Each company establishes its policies, leading to discrepancies in waiting times. Researching various insurance providers allows you to find the most favorable conditions.

- Policy Type: Comprehensive plans may offer shorter waiting periods as compared to basic plans. Opting for a more extensive policy might lessen the initial waiting time.

- Health History: Your personal health history and that of your surrogate may lead to different waiting periods. Insurers take into account existing conditions that might impact the speed of coverage activation.

Table of Common Waiting Period Scenarios

| Type of Waiting Period | Typical Duration | Relevant Factors |

|---|---|---|

| Initial Waiting Period | 0-6 months | Enrollment date, policy selection |

| Maternity Coverage | 3-12 months | Policy limitations, provider rules |

| Surrogacy Expenses | 6-18 months | Insurer’s specific terms, health assessments |

The Importance of Transparency

When assessing surrogate health insurance, transparency regarding waiting periods is essential. It’s advisable to engage in thorough discussions with prospective insurance providers about their specific waiting periods and any potential exceptions that might exist. Some insurers may offer the option to waive waiting periods under certain conditions, appealing to families eager to start their surrogacy journeys sooner rather than later.

evaluating waiting periods requires a meticulous approach. Being well-informed about the types of waiting periods, their lengths, and influencing factors will empower you to make a sound decision in your surrogacy insurance selection. Surrogate health insurance is a vital aspect of the journey, and understanding waiting periods can save you both time and stress.

3) Assessing Cost and Premiums

Understanding the Financial Landscape

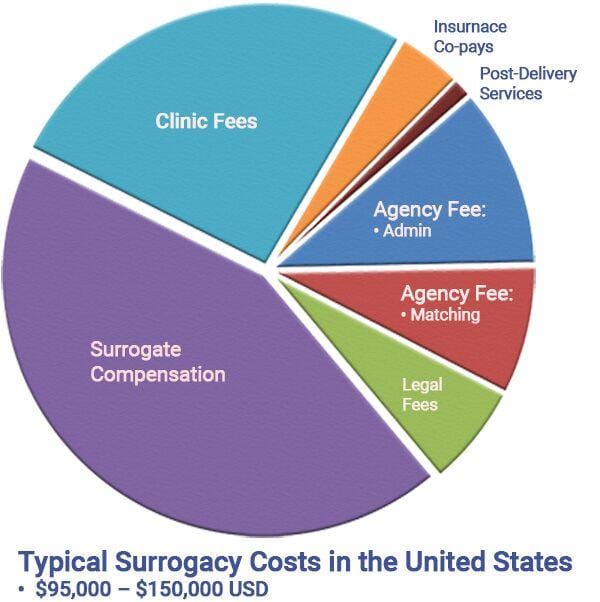

When it comes to selecting a surrogate health insurance plan, evaluating costs and premiums is a vital step. Since surrogacy can be an emotionally taxing journey, it’s essential to approach the financial aspect with a clear understanding of what you may be committing to. Costs can vary significantly among different policies, making it imperative to conduct thorough research.

Factors Influencing Costs

Several factors can directly influence the premiums associated with surrogate health insurance:

- Coverage Type: Comprehensive plans that cover a wider range of services typically come with higher premiums compared to basic coverage options.

- Geographical Location: Insurance costs can differ depending on the state or area, driven by local healthcare costs and regulations.

- Health of the Surrogate: A surrogate’s medical history and any pre-existing conditions may affect the insurance premiums, as insurers evaluate risk.

- Deductibles and Copayments: Policies with lower deductibles often have higher premiums. Assessing your potential out-of-pocket expenses can help you choose a plan that aligns with your budget.

Comparing Premiums

To make informed decisions, comparing premiums across various providers is crucial. Here’s a simplified table to highlight the importance of comparison:

| Insurance Provider | Monthly Premium | Coverage Limits |

|---|---|---|

| Provider A | $300 | $50,000 |

| Provider B | $450 | $75,000 |

| Provider C | $350 | $65,000 |

This table demonstrates how different insurance providers may offer varying premiums and coverage limits, reinforcing the need to not just focus on the price but also the value of the coverage you are obtaining.

Analyzing Long-Term Costs

In addition to monthly premiums, it’s crucial to consider long-term costs associated with your chosen plan. Factors that might incur additional costs include:

- Coverage Gaps: Some plans may not cover certain complications or treatments, resulting in unexpected financial strain.

- Future Healthcare Needs: If the surrogate requires additional care or follow-up treatments after birth, these costs can quickly add up.

- Policy Renewals: Monitor how your premiums might change during policy renewals. Insurers often reassess the risk profile, impacting future costs.

Your choice of surrogate health insurance should not only reflect immediate financial constraints but also anticipate potential long-term expenses. By meticulously assessing costs and premiums, you can make an informed investment in your journey through surrogacy, ensuring that financial decisions support rather than hinder the process.

4) Reviewing Network Providers

Assessing Provider Networks

When considering surrogate health insurance, a crucial aspect that often goes overlooked is the network providers associated with the plan. These providers determine the availability of medical professionals and facilities that will cater to your health needs during the surrogacy process. Understanding how the insurance provider’s network functions can help you make an informed decision that will impact your overall care.

In-Network vs. Out-of-Network

One of the first things to clarify is the difference between in-network and out-of-network providers. In-network providers are those that have agreements with the insurance company to offer services at reduced rates. Here are some points to consider:

- Lower Costs: In-network providers often mean lower out-of-pocket expenses, as insurance will cover a larger portion of medical costs.

- Higher Quality Control: Many insurance companies thoroughly vet in-network providers, ensuring they meet certain quality standards.

- Easier Referrals: Staying within the network can streamline the referral process if you require specialist services.

In contrast, using out-of-network providers might lead to significantly higher expenses, regardless of the coverage details.

The Importance of Provider Specialization

Not all healthcare providers are equipped to handle the unique challenges associated with surrogacy. Therefore, reviewing the specialization of network providers is vital. Ensure the providers available in your plan’s network have experience dealing with pregnancy, prenatal care, and the specific medical circumstances surrounding surrogacy. Consider the following:

- Obstetricians/Gynecologists: Look for professionals who specialize in high-risk pregnancies if the surrogate mother is categorized as such.

- Mental Health Support: Counseling services for both intended parents and surrogates can be essential. Verify that mental health providers are covered.

- Fertility Specialists: Ensure that the network includes fertility clinics familiar with surrogacy processes.

Geographic Accessibility

Geographic considerations play a significant role in assessing network providers. Since surrogacies involve numerous medical appointments, it’s essential to have convenient access to healthcare facilities. Factors to evaluate include:

- Proximity to Major Hospitals: Check whether the network includes hospitals known for comprehensive maternity care.

- Local Clinics and Labs: Availability of testing facilities close to the home or workplace can significantly reduce stress and travel time.

- Virtual Care Options: With the rise in telehealth services, ensure that your network provides options for virtual consultations, which can save time and facilitate easier communication.

| Essential Provider Types | Specialization Relevant to Surrogacy |

|---|---|

| Obstetricians | High-risk pregnancy management |

| Pediatricians | Newborn care and health assessments |

| Mental Health Professionals | Support for emotional well-being |

| Fertility Specialists | Guidance for assisted reproductive technologies |

User Reviews and Provider Ratings

Investing time to review user feedback on network providers can offer invaluable insights. Platforms that aggregate reviews can highlight the experiences of other intended parents and surrogates. Look for consistent patterns regarding:

- Communication Skills: Are the providers attentive and responsive?

- Patient Satisfaction: What do past patients say about their overall experience?

- Waiting Times: Are appointments typically on schedule?

Choosing the right provider through your surrogate health insurance network could significantly impact the success of the surrogacy journey and the emotional health of all parties involved. With careful consideration of these factors, you can ensure that you select not only an affordable plan but one that prioritizes quality care for everyone involved.

5) Checking for Fertility Treatments

Understanding the Importance of Fertility Treatments in Surrogate Health Insurance

When considering surrogate health insurance, it’s crucial to explore the available fertility treatment options that may be covered under your policy. Infertility can be a complex issue, and comprehensive coverage ensures that both the surrogate and intended parents have access to necessary medical interventions. Here are essential elements to check:

- Assessment of Coverage: Determine whether your policy includes treatment options like IVF (in vitro fertilization), IUI (intrauterine insemination), and egg/sperm donation. Understanding the specifics helps in making informed decisions.

- Pre-existing Conditions: Often, policies have clauses regarding pre-existing conditions. Check if fertility issues fall under this category, which could significantly affect treatment accessibility.

- Network of Providers: Ensure that your insurance covers a comprehensive network of fertility specialists and clinics. This access not only aids in prompt treatment but can also lead to better outcomes.

- Out-of-Pocket Costs: Carefully examine co-pays, deductibles, and co-insurance for fertility treatments. Surrogacy can incur additional expenses, making it imperative to understand which costs are covered.

Types of Fertility Treatments Typically Covered

To help you further compare policies, here’s a simplified view of common fertility treatments and their typical coverage status:

| Treatment Type | Common Coverage | Notes |

|---|---|---|

| IVF | Often covered | May require prior authorization |

| IUI | Usually covered | Limited to a specific number of cycles |

| Medications | Partially covered | Verify cost-sharing structure |

| Genetic Testing | Possibly covered | Check for specific policy conditions |

Beyond Basic Coverage: What to Investigate

Not only do you need to check what treatments are included, but it’s also important to consider additional aspects of fertility coverage in your surrogate health insurance:

- Limitations on Treatment Cycles: Some policies place caps on the number of cycles covered for specific procedures like IVF or IUI. Understanding these limits can help set realistic expectations.

- Fertility Preservation Services: For those needing to undertake treatments that may affect fertility, ask about coverage for egg or sperm freezing, which can be a crucial part of planning.

- Mental Health Support: Psychological support is often overlooked but can be essential during such a stressful process. Check if counseling or therapy sessions related to fertility issues are included.

Investing time in evaluating the nuances of fertility treatments within your surrogate health insurance can pay off significantly. By ensuring that you and your surrogate have access to the necessary care and support, you pave the way for a smoother surrogacy journey.

6) Investigating Maternity Care Benefits

Understanding Maternity Care Coverage

When selecting a surrogate health insurance plan, one of the primary factors to evaluate is the maternity care benefits included in the policy. This coverage can vary significantly among different insurers and policies, making it essential for intended parents to meticulously investigate what each plan offers.

Key Components of Maternity Care Benefits

While delving into maternity care benefits, it’s crucial to consider the following elements:

- Prenatal Care: Check if the plan covers regular check-ups and necessary screenings during the pregnancy.

- Delivery Costs: Understand what is included in terms of hospital stay, labor, and delivery services. Some plans may have limitations on location or specialists.

- Postpartum Care: Evaluate whether the coverage includes visits for the surrogate after the baby is born, which are vital for the health of both the surrogate and the newborn.

- Emergency Care: Confirm the policy provides coverage for unforeseen complications that may arise during pregnancy or delivery.

Comparing Coverage Options

To make an informed choice, it is beneficial to compare the maternity care benefits of various plans side by side. Below is an example table that highlights the differences and key coverage aspects:

| Insurance Provider | Coverage Includes | Costs Covered | Additional Benefits |

|---|---|---|---|

| Provider A | Prenatal, Delivery, Postpartum | Full hospital stay | 24/7 nurse hotline |

| Provider B | Prenatal, Limited Delivery | Partial delivery costs | Access to parenting classes |

| Provider C | Full Maternity Care | Full coverage including emergencies | Personalized case management |

Out-of-Pocket Expenses

Another critical consideration is the potential out-of-pocket expenses associated with maternity care. Different plans might have varying levels of deductibles, co-pays, and out-of-pocket maximums. Understanding these costs in advance can help intended parents budget efficiently and avoid unexpected financial burdens during this significant time in their lives.

Make sure to ask questions regarding coverage limits and any exclusions that may apply. Inquire about how much support the surrogate will receive throughout her maternity journey. Knowing the extent of coverage can contribute greatly to a smoother experience for all parties involved.

In the grand scheme of surrogate health insurance, investigating maternity care benefits is more than just checking boxes; it’s about ensuring that the surrogate feels supported and well-cared for during her pregnancy, which ultimately leads to a better experience for everyone involved.

7) Examining Prescription Drug Coverage

Understanding the Essentials of Prescription Drug Coverage

When evaluating surrogate health insurance plans, one of the most critical aspects to assess is the prescription drug coverage. This factor can heavily influence both the financial implications and the overall satisfaction with the surrogate health plan. Understanding how drug coverage works will ensure that you choose a plan that meets both your medical needs and budget.

Types of Drug Coverage Plans

Not all insurance plans offer the same level of prescription drug coverage. Here are the common types you might encounter:

- Formulary-based Plans: These plans have a list of covered medications, classified into tiers that determine co-pays or coinsurance.

- No Formulary Plans: These plans cover a wide range of medications without limitations but may have higher premiums.

- Mandatory Generic Substitution: Some plans require the use of generic medications whenever possible, ensuring cost-effectiveness.

Key Considerations for Selecting Your Drug Coverage

To make an informed decision, examine these aspects carefully:

- Formulary Accessibility: Check if the medications you or your surrogate may need are included in the formulary.

- Out-of-pocket Costs: Evaluate your potential expenses, including deductibles, co-pays, and coinsurance associated with prescription drugs.

- Pharmacy Network: Verify if there is a preferred pharmacy network that offers discounts or lower co-pays for your required medications.

- Prior Authorization Requirements: Understand the necessary approvals for certain medications, as this can delay treatment.

Comparing Costs: A Quick Table

Below is a brief comparison of costs related to different coverage types that can help you gauge what may work best for you:

| Plan Type | Average Monthly Premium | Typical Co-pay | Generic vs. Brand Medication Coverage |

|---|---|---|---|

| Formulary-based | $50 | $10 – $30 | Higher for Generics |

| No Formulary | $75 | $20 – $50 | Equal Coverage |

| Mandatory Generic | $55 | $5 – $15 | Low for Generics, Higher for Brands |

By closely examining these factors, you can ensure that your surrogate health insurance not only provides you with adequate prescription drug coverage but also aligns well with your financial situation and healthcare needs.

8) Understanding Legal and Contractual Obligations

Legal Framework for Surrogacy Agreements

When entering into a surrogacy arrangement, understanding the legal landscape is vital. Surrogate health insurance should ideally cover any medical expenses that arise during the pregnancy. Since surrogacy laws can vary significantly from one jurisdiction to another, it’s essential to consult with a legal expert specializing in reproductive law. They can help navigate complex regulations that dictate ownership of embryos, parental rights, and the enforceability of surrogacy contracts.

Key Components of Surrogacy Contracts

Every surrogacy contract should clearly outline the responsibilities and obligations of each party involved. Here are some critical elements that should be included:

- Financial Obligations: Detailing all amounts payable, including medical expenses, compensation, and other allowances.

- Health Insurance Coverage: Specifying the type of coverage the surrogate will receive, ideally enhancing her health and well-being throughout the pregnancy.

- Parental Rights: Clearly stating who will have legal rights over the child once born and the procedures for establishing these rights.

- Termination Clauses: Outlining circumstances under which the contract may be terminated and how assets and responsibilities will be handled in such cases.

How to Protect Yourself Legally

To ensure that all parties adhere to the legal obligations outlined in the surrogacy agreement, consider the following protective measures:

- Engage a Surrogacy Agency: A reputable agency can provide legal resources and help facilitate communication between the surrogate and intended parents.

- Legal Counsel: Both parties should have independent legal representation to validate the contract before signing it, ensuring that all obligations are fair and clear.

- Mediation Clause: Including a clause for mediation in case of disputes can facilitate easier resolution without the need for lengthy litigation.

Potential Legal Risks

Without a well-constructed agreement that addresses all aspects of the surrogacy process, you may face several legal risks:

| Risk | Description |

|---|---|

| Parental Rights Disputes | The possibility of challenges regarding the child’s legal parentage. |

| Medical Coverage Conflicts | Disagreements over who is responsible for medical bills incurred during the pregnancy. |

| Enforceability Issues | A contract that may not be recognized in some jurisdictions, leading to unenforceable agreements. |

Understanding the intricate details surrounding legal and contractual obligations is paramount for anyone considering surrogate health insurance. A solid grasp of these factors not only provides peace of mind for all parties involved but also safeguards against potential future complications stemming from misunderstandings or disputes.

9) Considering Out-of-Pocket Expenses

Understanding Out-of-Pocket Expenses

Navigating surrogate health insurance involves more than just selecting a policy; it necessitates a thorough examination of out-of-pocket expenses that may arise throughout the surrogacy journey. These costs can vary significantly based on individual circumstances, policy parameters, and the specific needs of both the surrogate and the intended parents. Evaluating these expenses is crucial for financial planning and ensuring comprehensive coverage.

Types of Out-of-Pocket Expenses

When assessing potential out-of-pocket costs, consider the following categories:

- Deductibles: The amount paid before your insurance starts to contribute can vary widely, impacting your overall expenditure.

- Co-pays: Fixed payments for specific services, such as doctor visits or specialist consultations, can accumulate quickly.

- Co-insurance: This is the percentage of expenses you must pay after meeting your deductible. Understanding your co-insurance rates is vital for estimating future costs.

- Non-covered services: Some policies may exclude certain treatments or medications, leading to unexpected out-of-pocket costs.

Estimating Potential Costs

Creating a comprehensive financial plan that includes potential out-of-pocket expenses is essential for intended parents. Utilize the following table to help estimate these costs effectively:

| Expense Type | Estimated Cost Range |

|---|---|

| Deductibles | $1,000 – $5,000 |

| Co-pays per visit | $20 – $150 |

| Co-insurance (after deductible) | 10% – 30% |

| Non-covered services | Varies widely |

These estimates provide a foundational understanding of the potential financial obligations associated with surrogate health insurance. If you anticipate specialized care for the surrogate, such as mental health services or fertility treatments, the costs could rise significantly.

Strategies to Mitigate Out-of-Pocket Expenses

To minimize out-of-pocket expenses, consider the following strategies:

- Review Plan Options: Not all surrogate health insurance policies are created equal. Compare various plans to find one that balances premium costs with coverage.

- Negotiate Rates: Engage with health care providers to negotiate rates for services that may not be covered under your plan.

- Save for Expenses: Set aside a dedicated fund to cover potential out-of-pocket expenses, easing financial pressure during the surrogacy process.

Being proactive in understanding and planning for out-of-pocket expenses can make a significant difference in the financial and emotional aspects of the surrogacy journey. By effectively managing these costs, intended parents can focus on building a family rather than being consumed by unexpected financial burdens.

10) Seeking Professional Guidance

Understanding the Importance of Professional Guidance

When navigating the complexities of surrogate health insurance, seeking professional guidance can be a game-changer. Insurance providers often have intricate policies, and understanding the nuances can be overwhelming for intended parents and surrogates alike. Consulting with experts can demystify these processes and provide clarity on making informed decisions.

Types of Professionals to Consult

While there are various types of professionals available to help, consider focusing on the following:

- Insurance Brokers: They can provide insights into different health insurance policies specifically designed for surrogacy.

- Legal Advisors: Attorneys specializing in reproductive law can clarify legal entitlements and obligations regarding insurance coverage.

- Financial Planners: They can help budget for potential health care expenses associated with surrogacy, including insurance premiums and out-of-pocket costs.

- Healthcare Providers: Physicians can inform about the medical aspects and what coverage one should ideally look for in a policy.

The Benefits of Professional Advice

Engaging professionals offers several advantages:

- Tailored Recommendations: Experts can suggest policies or plans that align closely with your specific needs.

- Risk Management: By understanding the risks involved, you can better prepare for unexpected health issues that may arise during the surrogacy journey.

- Policy Negotiation: Professional negotiators may enable better terms and rates on policies than individuals can usually secure on their own.

Choosing the Right Expert

Finding the right coach or mentor makes a significant difference in navigating surrogate health insurance. Consider the following attributes before selecting:

| Criteria | Questions to Ask |

|---|---|

| Experience | How long have you worked in the surrogacy insurance industry? |

| Reputation | Can you provide testimonials or references from past clients? |

| Specialization | Do you focus on surrogacy health insurance specifically? |

The insight from industry professionals can significantly reduce the stress of the surrogate health insurance journey. Not only will they help clarify complex terminologies, but they will also assist in enhancing the overall experience, empowering both surrogates and intended parents to approach the process with confidence.

What is surrogate health insurance?

Surrogate health insurance is a specialized policy that provides coverage for surrogates during their pregnancy journey. It typically includes medical expenses related to prenatal care, labor, delivery, and any potential complications. Understanding what this insurance covers can help intended parents ensure that their surrogate’s health is fully protected.

Why is surrogate health insurance important?

Surrogate health insurance is crucial because it safeguards the well-being of the surrogate and the intended parents. Without appropriate coverage, unexpected medical costs can arise during pregnancy, which can financially burden intended parents and emotionally stress the surrogate. Ensuring extensive coverage can mitigate these risks.

What types of coverage do surrogacy insurance plans typically include?

Most surrogate health insurance plans will cover:

- Routine prenatal visits

- Ultrasounds and diagnostic tests

- Labor and delivery costs

- Postnatal care for the surrogate

- Potential hospitalization or emergency care

It’s essential to review each plan’s specifics, as coverage can vary widely among insurance providers.

Are there exclusions in surrogate health insurance?

Yes, most policies include exclusions. Common exclusions found in surrogate health insurance plans may include:

- Pre-existing conditions

- Treatments that are not medically necessary

- Complications arising from prior pregnancies

Always read the fine print of the insurance policy to understand what is and isn’t covered.

How can intended parents find a suitable surrogate health insurance plan?

Intended parents can start by consulting with fertility clinics or surrogacy agencies, as they often have partnerships with insurance providers. Additionally, researching online and comparing different plans can help in making an informed decision. Websites such as Resolve: The National Infertility Association, a comprehensive source for all things related to surrogacy and fertility.

Thank you for joining us on this informative journey. We hope the insights shared here will assist you in making the best choices for your surrogacy experience. Embrace the adventure ahead, and remember that informed decisions lead to empowered journeys.